MTD Impact Across the Landlord Market

The scale & impact become clear when looking at landlord demographics. HMRC research shows that 99% of declared rental income comes from individual investors, with only 1% from partnerships. The average property income per landlord rose to £19,400, suggesting many will eventually fall within scope as thresholds continue to decrease.

From 2026, HMRC predicts over 700,000 property investors will be affected by the £50,000 threshold, growing to well over 1 million when the threshold drops to £30,000 in 2027. The biggest impact will come in 2028 when nearly all individual landlords are expected to be subject to reporting as the threshold falls to £20,000.

Geographic concentration adds another layer of complexity, with London-based accounting for 17% of all unincorporated individuals but 27% of the property income, and 43% of declared income coming from London and the South East.

Expert Guidance for Landlords and Property Investors to Maximise Returns and Stay Compliant with HMRC Requirements

Are you a landlord or property investor feeling confused about Making Tax Digital requirements? You’re definitely not alone here. With 2.86 million individuals declaring rental income and major changes set to roll out in 2026, these new compliance rules can feel overwhelming.

Here’s the good news: with proper guidance and some advance preparation, you can actually turn this challenge into a chance to streamline your property business and dodge those costly penalties.

If you are a landlord or property investor, please ensure you register for our next webinar here

MTD Introduction for landlords & property investors

The UK’s tax landscape is going through its biggest transformation in decades. According to HMRC, over 4 million individuals, including landlords and property investors, will soon face major changes due to Making Tax Digital (MTD) for Income Tax Self-Assessment (ITSA).

This revolution, starting from April 2026, represents what Simon Misiewicz, FCCA, ATT, EA, MBA, calls “the biggest shake-up to landlord compliance in a generation. Quarterly reporting means more admin, but also more opportunities for proactive planning.”

With 2.86 million individuals declaring rental income via Self Assessment in 2023-24 and a total declared rental income of £47.62 billion, The impact will ripple through the entire property investment sector.

The Problem: MTD is Transforming Property Tax Forever

You’ve worked hard to build a successful property portfolio, but now HMRC is completely overhauling how you report rental income. Starting in April 2026, landlords with gross rental income above £50,000 must switch from traditional annual tax returns to quarterly digital reporting.

This isn’t just some minor paperwork tweak. You’re looking at:

External Problems: Complex software requirements, quarterly deadlines, penalty systems, and mandatory digital record-keeping that completely replaces your current methods.

Internal Problems: Stress about staying compliant, confusion over which software to choose, fear of penalties, and frustration with regulations that are constantly changing.

The Bigger Picture: You shouldn’t need to become a tax expert just to protect your property investments. What you need is a clear roadmap that ensures compliance while maximising your returns.

Understanding Making Tax Digital for landlords is essential.

MTD for income tax is HMRC’s push to digitise their systems, replacing old-school paper records and annual returns with real-time digital reporting. For landlords and property investors, this means a complete overhaul in how you track and report rental income.

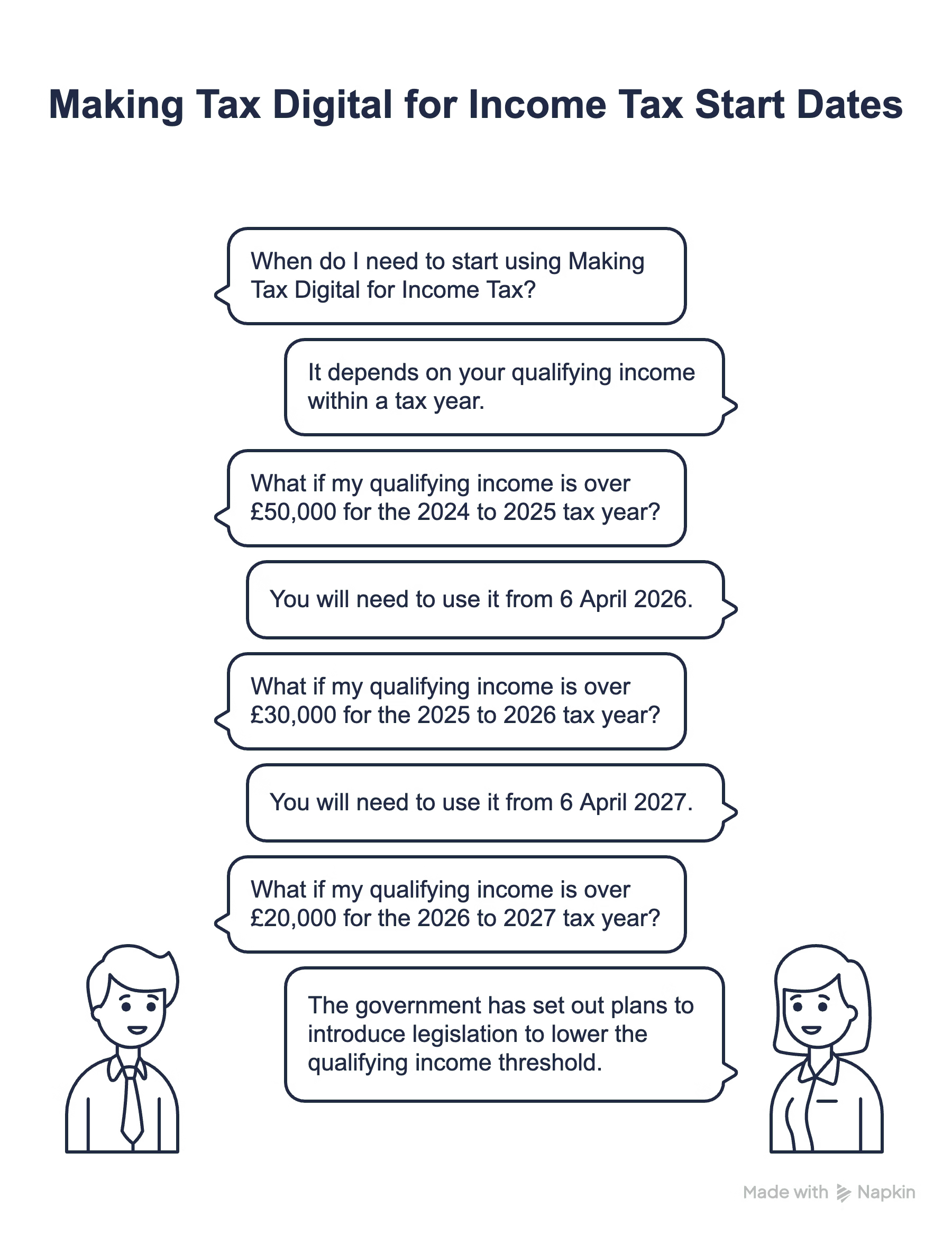

Landlords with gross rental income above £50,000 must comply from April 2026, maintaining online records and submitting quarterly updates, as well as a final declaration, through MTD-compliant software. It’s worth noting that the income threshold is based on gross income, not profit after expenses, and includes rental income and self-employment income, but not employment or pension income.

The rollout continues with landlords with gross rental income above £30,000 joining from April 2027. Under these thresholds can opt in voluntarily but aren’t required to, while HMRC continues to review what to do about those with income below £30,000.

Real-world Scenario: What Does MTD Mean for You?

The shift from annual to quarterly reporting is the biggest change landlords will face. In the past, you’d file one self-assessment for the year ending April 5th by January 31st the following year. You will need to make quarterly digital submissions plus an annual End of Period Statement (EOPS).

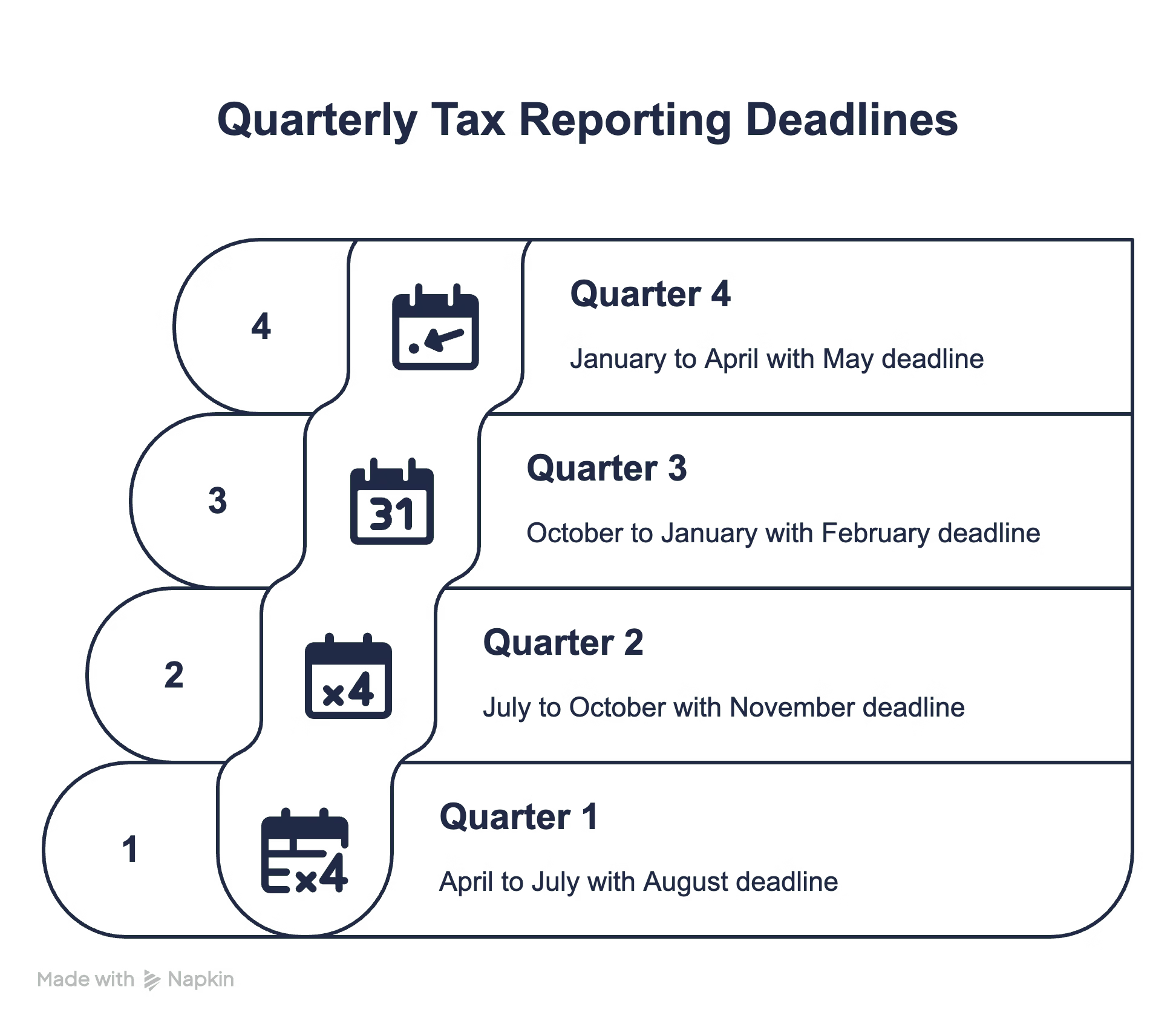

The standard quarterly reporting dates are:

– Quarter 1: 6 April to 5 July (submission due by 5 August)

– Quarter 2: 6 July to 5 October (submission due by 5 November)

– Quarter 3: 6 October to 5 January (submission due by 5 February)

– Quarter 4: 6 January to 5 April (submission due by 5 May)

These quarterly updates must be submitted within one month after each quarter ends, followed by a final declaration by the usual January 31st deadline.

Think about a landlord with several buy-to-let properties generating over £50,000 in yearly rental income. Instead of one annual return, they’ll need to provide quarterly updates while maintaining comprehensive records throughout the year.

The Penalty Reality: What Non-Compliance Costs

Understanding HMRC’s penalty system helps you see why proper preparation is so crucial. The points-based system assigns one penalty point for each missed deadline.

For quarterly reporting, 4 points trigger a £200 penalty, which means missing just four quarterly submissions hits you with significant financial consequences. What’s particularly worth noting is that points expire after 24 months if you maintain compliance.

Late payment penalties have also jumped substantially.

- From April 2025, 3% penalty applies if tax remains unpaid 15 days after the due date,

- 6% after 30 days, and

- 10% per annum for amounts outstanding beyond 31 days.

| Area | Rules | Key Details / Consequences |

|---|---|---|

| Points-Based System | 1 penalty point per missed deadline | Points expire after 24 months if compliance is maintained |

| 4 points = £200 penalty | Missing four quarterly submissions triggers an automatic £200 fine | |

| Late Payment Penalties (from April 2025) | 3% penalty if unpaid after 15 days | Applied to the tax still outstanding |

| 6% penalty if unpaid after 30 days | Increases financial risk quickly | |

| 10% per annum for amounts overdue after 31 days | Annualised penalty until tax is paid in full |

Your Simple Path to MTD Success

We’ve guided thousands of property investors through these changes successfully. Here’s your straightforward three-step approach:

| Step | Activity | Key Details & Aims |

|---|---|---|

| Step 1 | Assess Your MTD Requirements | Determine when you must comply: income >£50,000 from April 2026, >£30,000 from April 2027, >£20,000 from April 2028. Thresholds are based on gross rental income (including multiple properties and self-employment). |

| Step 2 | Choose Your MTD-Compatible Software | Select software suited to your needs: Xero (portfolio landlords, HMRC integration), FreeAgent (smaller portfolios, quarterly reporting), Hammock / Landlord Vision (property-focused, built-in compliance). |

| Step 3 | Ensure Ongoing Compliance | Submit quarterly updates by 5 Aug, 5 Nov, 5 Feb, 5 May, plus a final declaration by 31 Jan. Keep accurate records to stay compliant and avoid penalties. |

Step 1: Assess Your MTD Requirements

Begin by determining your compliance timeline. The thresholds are straightforward: landlords with an income over £50,000 must comply from April 2026, those with an income over £30,000 from April 2027, and those with an income over £20,000 from April 2028.

Keep in mind, these thresholds are based on gross rental income, not your actual profit. If you’ve got multiple properties or other self-employment income, it all counts toward the total.

Step 2: Choose Your MTD-Compatible Software

Your software choice will make or break the smoothness of this transition. Based on our experience helping property investors, here are the most effective options:

For portfolio landlords, Xero delivers comprehensive cloud accounting with robust property management features and direct HMRC integration.

For smaller portfolios, FreeAgent for landlords offers user-friendly tools specifically designed for property investors, featuring excellent quarterly reporting capabilities.

For Property-Focused Management: Hammock and Landlord Vision are designed specifically for rental property management, with MTD compliance already built in.

Step 3: Ensure Ongoing Compliance

Once you have your system running, maintaining compliance becomes relatively routine. You’ll submit quarterly updates by specific deadlines: August 5th, November 5th, February 5th, and May 5th, followed by your final declaration by January 31st.

Your MTD Preparation Timeline

| Timeline | Key Actions | Preparation Goals |

|---|---|---|

| 12 Months Before | – Calculate gross rental income to confirm compliance date– Research MTD-compatible software– Start digitising records | Establish compliance timeline and prepare systems early |

| 6 Months Before | – Select and purchase chosen software– Run parallel digital and paper systems– Train yourself or team on processes | Smooth transition with minimal disruption |

| 3 Months Before | – Complete software setup and data migration– Run test quarterly submissions– Set up automated bank feeds and expense categorisation | Ensure systems work correctly before going live |

| 1 Month Before | – Finalise system configurations– Implement backup and security measures– Prepare for first mandatory quarterly submission | Be fully ready for HMRC compliance from day one |

12 Months Before Your Deadline:

- Calculate your gross rental income to confirm your compliance date

- Research MTD-compatible software options

- Start digitizing your current records

6 Months Before:

- Select and purchase your chosen software

- Begin running parallel digital and paper systems

- Train yourself or your team on new processes

3 Months Before:

- Complete software setup and data migration

- Run test quarterly submissions if possible

- Set up automated bank feeds and expense categorisation

1 Month Before:

- Finalise all system configurations

- Make sure backup and security measures are in place

- Prepare for your first mandatory quarterly submission

The Learning Curve: Preparing for Digital Transformation

Many landlords don’t realise how steep the learning curve can be when transitioning to digital record-keeping. Switching from annual paperwork to quarterly submissions requires not just new software but a fundamental change in how you handle property finances throughout the year.

It’s crucial to build in time for training and testing before your first mandatory submission. This prep time allows you to identify category errors, resolve data mismatches, and establish smooth processes before compliance becomes mandatory.

Take a landlord with gross rental income exceeding £50,000 as an example: they evaluated different accounting software options in early 2025 and selected Hammock, moving away from Excel spreadsheets well before their April 2026 deadline. This early switch allowed for a full year of digital record-keeping and quarterly updates, minimising disruption and ensuring consistent data.

Joint ownership situations make preparation even more complex. Landlords holding property in joint names face additional requirements, with each owner needing to maintain separate records due to individual reporting obligations, even if one person handles the day-to-day finances.

Real Success Stories: How Landlords Are Preparing

Early Software Adoption: A landlord with two rental properties earning more than £50,000 consulted their accountant early and chose bridging software that connects Excel to HMRC’s systems. This approach kept workflow disruption to a minimum while ensuring compliance with quarterly reporting requirements.

Portfolio Optimisation: An accounting firm successfully transitioned multiple buy-to-let clients to FreeAgent, providing comprehensive training and onboarding support. The automated record-keeping and expense categorisation significantly cut down on errors and saved tons of time during tax preparation.

Joint Ownership Solutions: Tax advisors implemented systems that allow each joint property owner to maintain separate digital records and submit individual quarterly updates, ensuring accurate proportional reporting despite shared property management responsibilities.

Special Considerations for Different Landlord Types

Understanding who is and isn’t affected helps with proper planning. Limited companies and trusts aren’t yet included. These structures will continue with their existing corporation tax processes for now.

Cross-border individuals face unique considerations. Those living abroad but owning UK property remain subject to MTD if their income exceeds the relevant thresholds, requiring careful coordination between UK obligations and their overseas responsibilities.

Exclusion exemptions are in place for specific situations. Permanent exemptions apply to certain groups, while temporary or permanent exemptions may be available if you can show exclusion through lack of technology access, or inability to use it due to age, disability, or remote location. However, HMRC must approve exemption requests, which require documented evidence and a clear rationale.

Industry guidance stresses the importance of accurately forecasting their income near the threshold. If you’re approaching the £50,000 or £30,000 thresholds, review all property and ancillary income sources early, consulting with advisors to determine your likely obligations and plan transitions accordingly.

About Us – Experts for Landlords & Property Investors

At Optimise Accountants, we specialise in guiding landlords and property investors through the challenges of HMRC requirements. With over 20 years of experience in UK property tax, our team has helped thousands of investors—from single-property to high-net-worth portfolio owners—transition smoothly into HMRC’s system.

Our founder, Simon Misiewicz FCCA ATT EA MBA, is a Chartered Certified Accountant, ATT-qualified adviser, and IRS Enrolled Agent. Simon’s expertise has been featured in national publications, and he regularly provides commentary on HMRC legislation.

We combine technical knowledge with hands-on property experience, giving individuals the confidence to stay compliant while maximising their financial returns. Our approach focuses on:

Helping investors adopt HMRC-approved MTD software (Xero, FreeAgent, Landlord Vision, Hammock).

Ensuring accurate quarterly reporting so you avoid penalties and costly mistakes.

Offering tailored planning strategies that integrate rental income, capital gains,

At Optimise Accountants, we specialise in guiding property investors through the complexities. With over 20 years of experience in UK property tax, our team has helped thousands of investors—from single-property landlords to high-net-worth portfolio owners—transition smoothly into HMRC’s tax system.

Frequently Asked Questions

Landlords and property investors with rental income exceeding £50,000 annually from April 2026 must comply, expanding to those earning over £30,000 from April 2027.

Quarterly updates must be submitted within one month after the end of each quarterly period.

Yes, but they must use bridging software that links spreadsheets to HMRC's systems.

Non-compliance may result in financial penalties and interest charges on outstanding tax payments.

This simplifies record-keeping, enhances accuracy, reduces errors, and provides greater visibility and control over financial affairs.