How much CGT UK will I pay when selling a rental property? How to avoid it

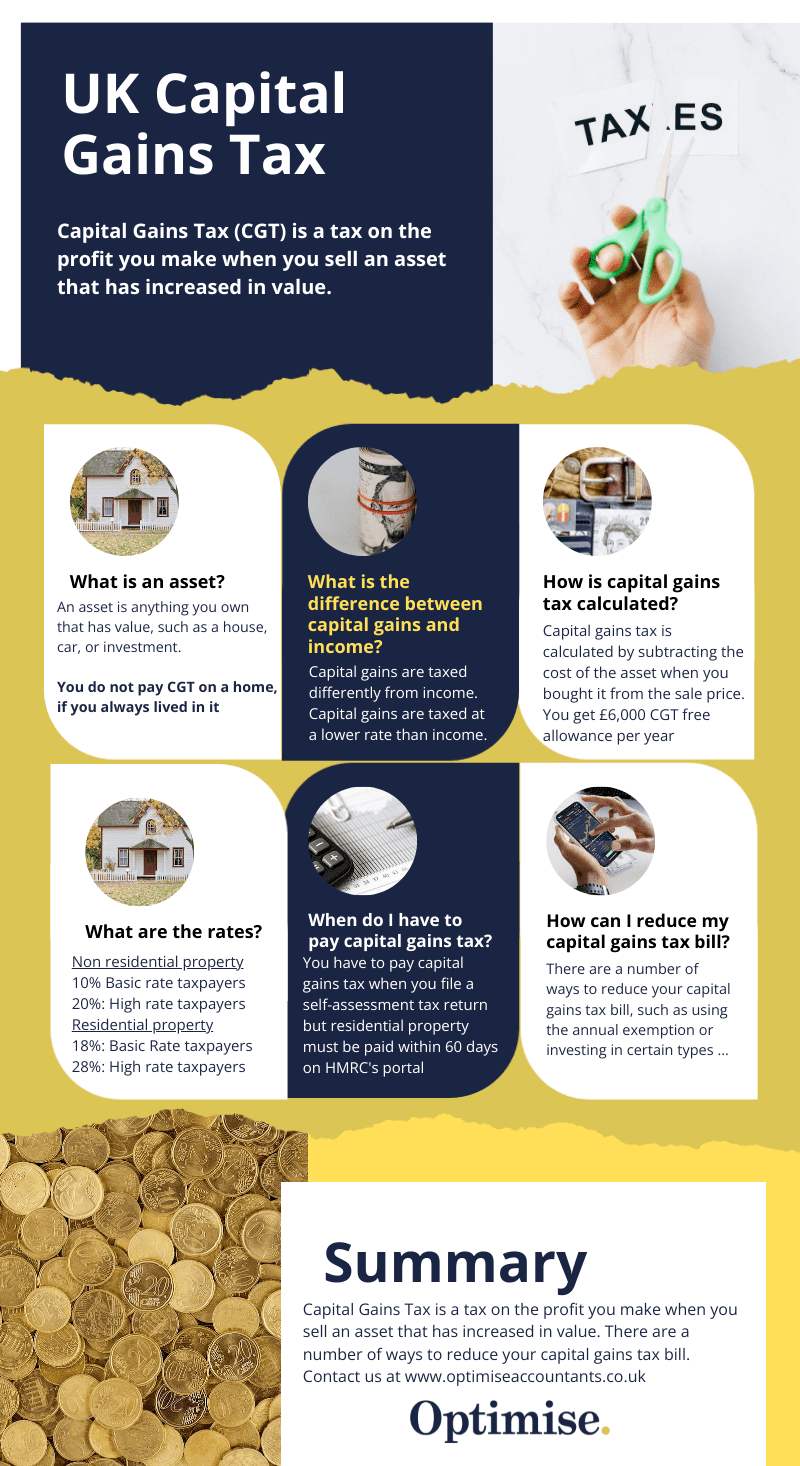

The Government requires that you only pay CGT if your gains throughout the year exceed the Annual Exempt Amount (AEA). There are several CGT rates you need to be aware of.

One way to avoid CGT is to use your tax-free annual allowance is £12,300 for individuals. Keeping your profits below this threshold is a straightforward way to avoid paying CGT on a property portfolio. Please also do not forget that everyone has a CGT annual allowance and, at the time of writing, it was £12,300. Married couples and civil partners get this allowance, meaning they get £24,600 combined.

The excess of £12,300 is subject to 18% CGT for basic rate taxpayers or 28% for high rate taxpayers.

This needs to be carefully monitored as a property gain could push a property investor from basic to the higher tax rate during a year, meaning you would also need to pay CGT at the 28% rate. You should use a capital gains tax calculator to work out and avoid your CGT liability before selling the property. That way, you can identify some reduction strategies.

It is our job to help landlords identify plans in avoiding capital gains tax on property situated in the United Kingdom (UK)

.Example of CGT rates

Sarah buys a property for £100,000 and incurs £500 legal fees and other associated finance arrangement fees of £2,500. She spends £5,000 on improvement costs.

Sarah sells the property for £120,00. She pays the estate agent £1,500 and solicitors £500.

£120,000 sales proceeds

£100,000 less the purchase price of the property

£5,000 Less Property improvement costs

£1,000 Less legal/solicitors fees £500 x 2

£1,500 Less estate agent fees

£2,500 Less arrangement fees

£10,000 taxable profit

Please note the acquisition costs and sales costs are not revenue items. I have seen many accountants and clients treat these incorrectly. You need to include all costs to avoid CGT.

The profit of £10,000 is less than the CGT-free allowance of £12,300. She does not have a HMRC bill on this profit and will avoid it.

Any excess gains over the £12,300 CGT allowance would be subject to an 18% CGT rate for basic taxpayers and 28% for high rate taxpayers. The same rate also applies to additional tax ratepayers.

It is always useful to check your CGT workings with your accountant before submitting your return to HMRC.

Avoiding Capital Gains Tax on property UK is an important feature for all landlords and is supported by our property accountants.

Who pays Capital Gains Tax and when is it due?

You must report and pay any Capital Gains due to HMRC within 60 days of the sale of a buy to let property. It might be advisable to use our capital gains tax calculator whilst booking a call with one of our property accountants to see what reductions you can make.

How long do I need to live in a house to avoid UK CGT?

There is a relief if you have lived in a property and used it as your main home residence. Private Residence Relief will help you reduce CGT.

Living in a house helps landlords in Avoiding CGT on property UK. It is a simple and effective way to pay HMRC any money.

Residential Property Investment - Transferring to a Limited Company

Selling a property to a third party or your own limited company is treated in the same way for tax purposes. CGT will be payable if a gain is made. It is possible to claim incorporation relief when transferring properties into a limited company to avoid paying CGT. Incorporation relief is not something that you can easily understand or do on your own. You will need to speak with a property accountant to ensure that this relief is applicable and workable.

Incorporate your property portfolio into a buy-to-let limited company to avoid tax.

Avoid UK CGT when transferring a buy to let property to a child.

Parents may wish to transfer a buy-to-let or second home to their children. This can be done, but they need to know that a CGT bill is likely to arise. The Gain will be based on the market value less the purchase price and capitalised items. You will note the words market value. This prevents a parent from transferring an asset for less than it is worth.

We have written a separate article for UK landlords wishing to avoid tax when transferring property into a trust for children. You can avoid both CGT and SDLT. You will need to work out the CGT and add this to the SDLT to see how much you can save.

Avoid tax When Getting A Divorce

There are many considerations when getting a divorce. You may need to pay CGT and Stamp Duty Land Tax when getting a divorce. With careful planning, it is possible to avoid paying CGT to HMRC when getting a divorce.

How do Enterprise Investments Schemes help avoid CGT

It is possible for you to invest in an Enterprise Investment Scheme (EIS) and get tax relief. There are two reliefs. The first is a 30% income tax reducer of the amount invested into an EIS. The other is the deferral of the capital gains made on selling a property.

Using EIS investments can be a great way to avoid paying CGT and reduce your income tax liability.

Roll over relief when buying a replacement business asset